Carapeastra Insights

Your go-to source for news and information on a variety of topics.

Get Ready to Quote: The Secret Life of Insurance Prices

Uncover the hidden factors driving insurance prices. Get ready to quote and save big with secrets revealed in our latest blog!

Understanding the Factors That Influence Your Insurance Quote

When obtaining an insurance quote, several factors come into play that can significantly influence the final amount you are presented with. First and foremost, your personal information, including age, gender, and location, plays a crucial role. For instance, younger individuals might face higher premiums for auto insurance due to statistical data indicating they are more likely to be involved in accidents. Furthermore, your credit score can also affect your quote, as insurers often use this information to assess risk.

Additionally, the type of coverage you select is a major determinant in the pricing of your insurance quote. The level of coverage, deductibles, and any additional riders can either increase or decrease your premium. For example, opting for a higher deductible may lower your monthly payment, but it's essential to consider your financial capacity to pay that amount in the event of a claim. Other influencing factors include your driving history for auto insurance, past claims for home insurance, and even the safety features of your vehicle. Understanding these variables can empower you to make informed decisions when shopping for insurance.

How to Decode Insurance Pricing: Tips for Savvy Shoppers

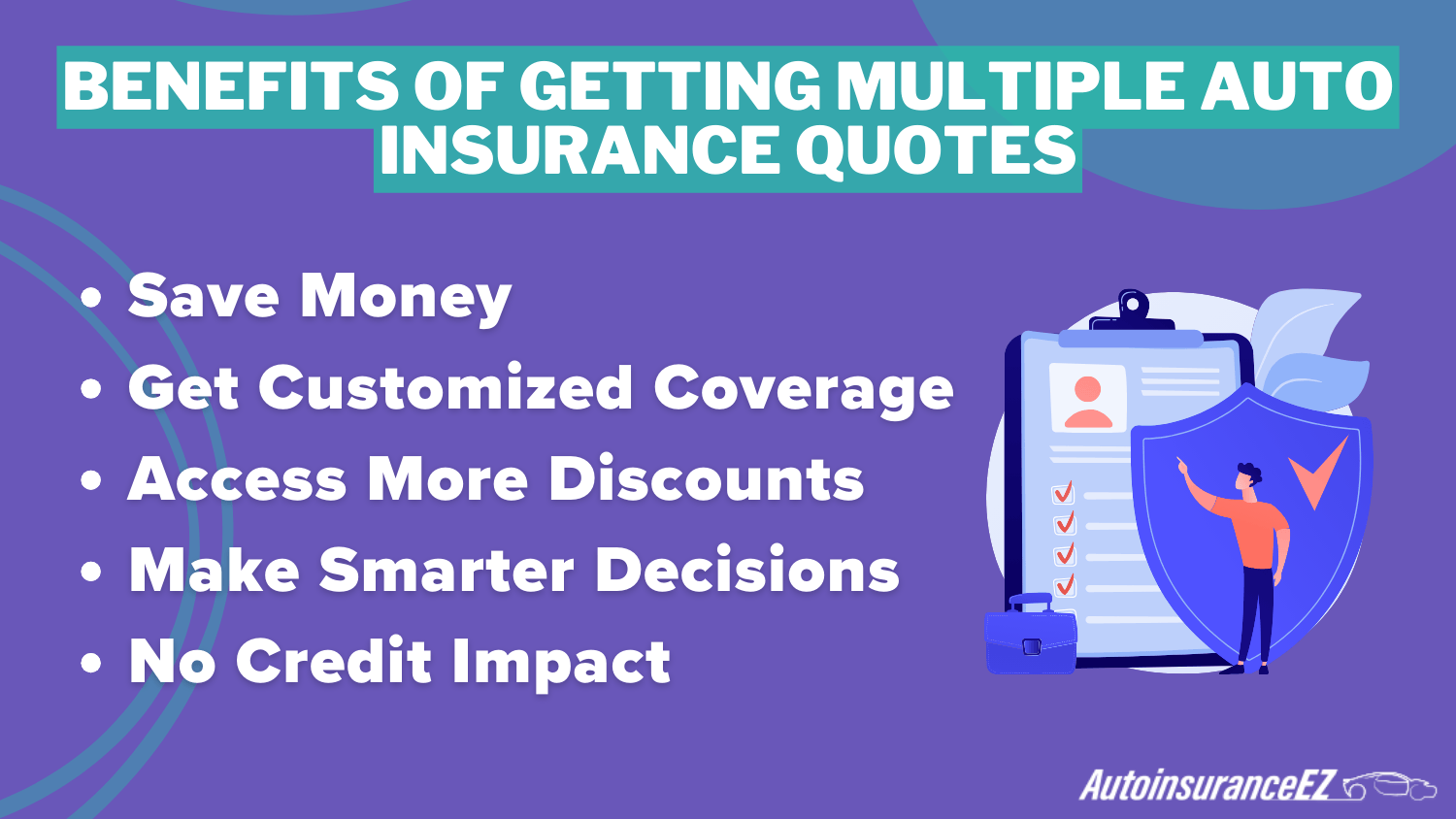

Understanding insurance pricing can often feel like navigating a maze, but with the right approach, savvy shoppers can unlock the secrets to better deals. Insurance pricing varies based on several factors including your age, location, and the type of coverage you seek. To decode these prices, start by obtaining quotes from multiple insurance providers. This gives you a clearer picture of the market rate. Additionally, understanding the different components of your premium, such as deductibles, coverage limits, and discounts, can empower you to make informed decisions that directly affect your costs.

Another key tip for being a savvy shopper is to review your policy regularly. Changes in your life circumstances, such as moving to a new home or changes in your credit score, can influence your insurance rates. Furthermore, consider grouping your policies for potential discounts. Many insurers offer special rates for bundling different types of coverage, like home and auto insurance. By following these steps, you can take charge of your insurance pricing and ensure you’re getting the best value for your money.

The Hidden Costs: What Affects Your Insurance Premiums?

When it comes to insurance premiums, many people focus solely on the obvious factors, such as their driving record or property location. However, there are several hidden costs that can influence your premiums in significant ways. For instance, your credit score can have a profound impact on the rates you receive. Insurers often use credit scores as an indicator of risk, meaning that individuals with lower credit ratings may face higher premiums. Additionally, the type of coverage you choose and any add-ons, like comprehensive or collision coverage, can also inflate your costs unexpectedly.

Other hidden factors include your claims history and even the make and model of your vehicle. Frequent claims can raise your risk profile, resulting in higher premiums over time. Similarly, driving a car with high theft rates or expensive repair costs can lead to increased insurance costs. It's also important to consider location-specific variables, such as crime rates or natural disaster risks, which can be easily overlooked. Understanding these hidden costs can empower you to make informed decisions about your insurance and potentially save you money.