Carapeastra Insights

Your go-to source for news and information on a variety of topics.

Insurance Quotes That Won't Break the Bank

Discover affordable insurance quotes that save you money without sacrificing coverage. Start your journey to savings today!

How to Find Affordable Insurance Quotes Without Sacrificing Coverage

Finding affordable insurance quotes doesn't have to mean compromising on coverage. Start your search by leveraging online comparison tools that allow you to quickly view multiple insurance options side by side. Websites like Insurance.com provide a user-friendly interface to compare rates from various insurers. Additionally, consider reaching out to local insurance agents who can provide personalized quotes based on your unique needs and circumstances. This hybrid approach ensures you get a comprehensive view of your options without overlooking critical details that could impact your coverage.

It's also important to assess your own coverage needs before diving into the quotes. Make a list of necessary features, such as liability limits or specific policy riders, and use this list to filter your options effectively. Remember, while affordable insurance quotes are enticing, ensure that the policy you choose aligns with your risk tolerance and financial situation. For more tips on maximizing your insurance savings while maintaining good coverage, check out NerdWallet.

Top 5 Tips for Getting the Best Insurance Quotes on a Budget

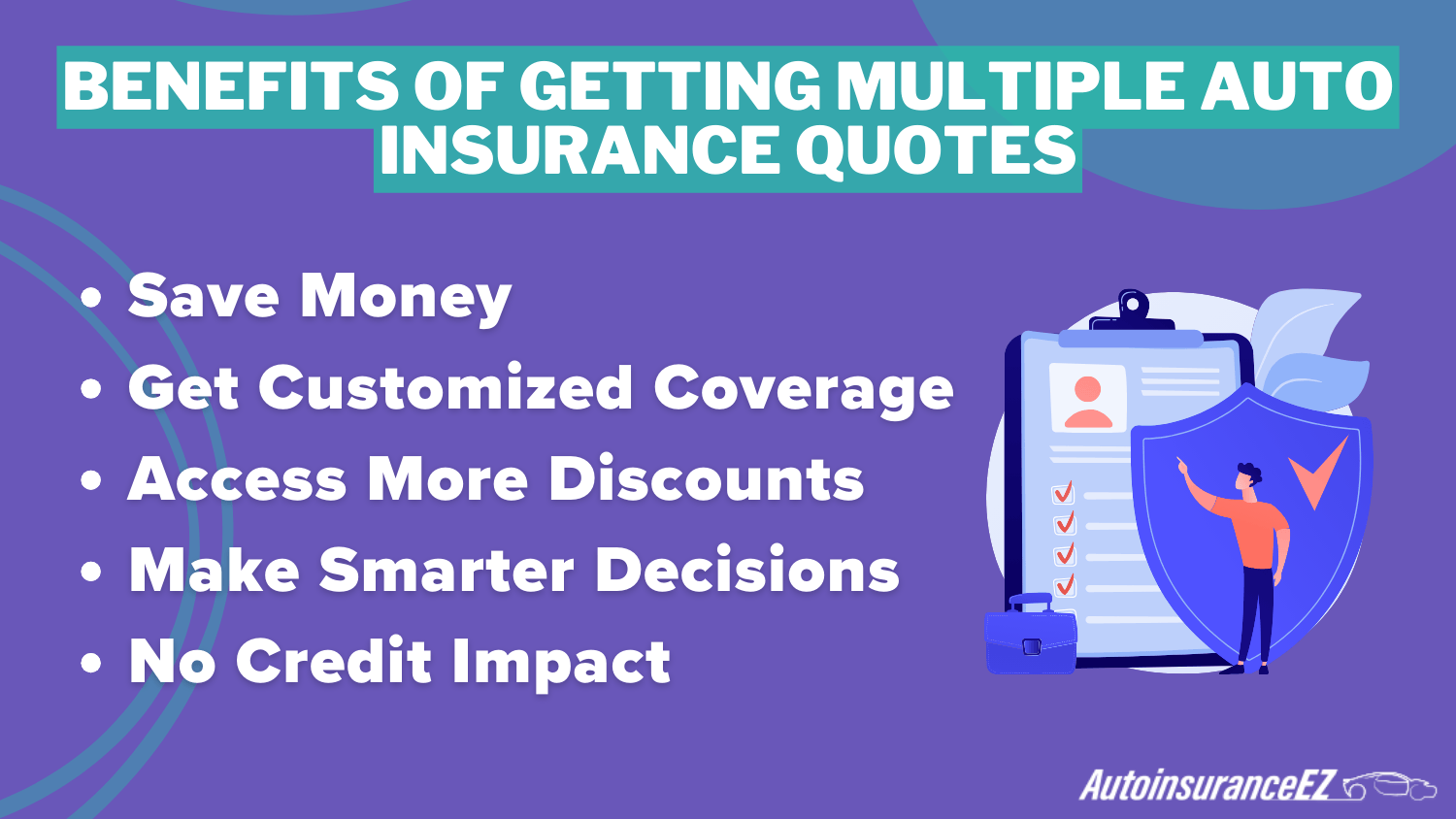

Getting the best insurance quotes on a budget can seem daunting, but with the right strategies, it can be manageable. Start by comparing quotes from multiple providers. Websites such as Insure.com allow you to input your details and receive customized quotes from various companies. Additionally, consider using online comparison tools to directly analyze costs and coverage options side-by-side. Remember, a lower premium doesn’t always mean better value, so pay attention to the coverage limits as well.

Another effective tip is to bundle your insurance policies. Many insurance companies, like State Farm, offer discounts for customers who combine home, auto, and other types of insurance. This can significantly reduce your overall costs. Also, do not hesitate to ask about discounts. Whether it's for safe driving, membership affiliations, or even good student discounts, every little saving helps when you are trying to stick to a budget.

Common Myths About Cheap Insurance Quotes You Need to Know

There are numerous myths about cheap insurance quotes that can lead consumers astray. One prevalent misconception is that affordable insurance means compromised coverage. In reality, many insurance providers offer competitive rates without sacrificing the quality of service or the extent of coverage. It’s essential to consider the factors that contribute to these quotes, such as geographical location, driving record, and eligible discounts. For more insights on how coverage and price correlate, check out this National Association of Insurance Commissioners article.

Another common myth is that cheap insurance quotes are always the result of inferior companies. While some low-cost policies may come from lesser-known insurers, many reputable companies offer budget-friendly options. The key is to conduct thorough research, examine customer reviews, and ensure that the provider is financially stable. Utilizing resources like NerdWallet's guide can help you make informed decisions when selecting an insurance provider that meets your needs without breaking the bank.