Carapeastra Insights

Your go-to source for news and information on a variety of topics.

Crypto Market Volatility: A Rollercoaster Ride Through Financial Wonderland

Dive into the thrilling world of crypto market volatility and discover the wild swings that can turn fortunes overnight!

Understanding Crypto Market Volatility: Key Factors Behind the Fluctuations

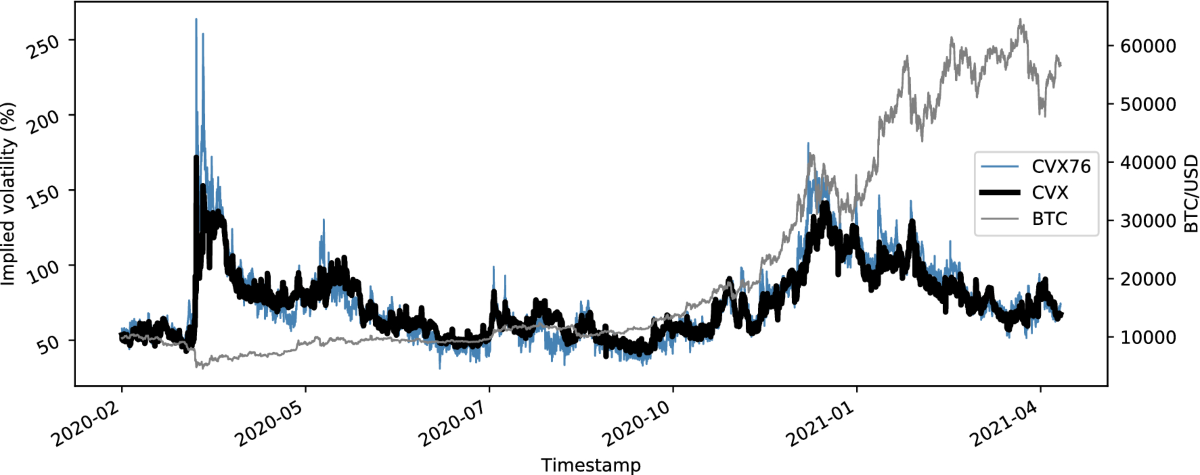

The crypto market volatility is a defining characteristic of digital currencies, often leading to significant price fluctuations over short periods. Understanding the key factors behind these fluctuations is crucial for investors and enthusiasts alike. One major factor is market sentiment, which can be influenced by news, social media trends, and regulatory developments. Positive news can lead to a surge in prices, while negative headlines may trigger panic selling. Additionally, the relatively low market capitalization of many cryptocurrencies compared to traditional assets makes it easier for large trades or 'whales' to manipulate prices.

Another important factor contributing to crypto market volatility is liquidity. Unlike established markets, many cryptocurrencies have lower trading volumes and liquidity, which can result in larger price swings from single transactions. Furthermore, technological factors such as network congestion and transaction delays can exacerbate price movements. As the crypto market continues to evolve, understanding these dynamics becomes essential for navigating the unpredictable landscape and making informed investment decisions.

Counter-Strike is a highly popular first-person shooter game that has captivated gamers since its release. Players engage in intense team-based combat scenarios, focusing on strategy and skill. For those looking to enhance their gaming experience, using a cloudbet promo code can provide various benefits and bonuses.

How to Navigate the Ups and Downs of Cryptocurrency Trading

Cryptocurrency trading can often feel like a rollercoaster ride, filled with the ups and downs that challenge even the most seasoned investors. To navigate this volatile market, it’s essential to establish a solid trading plan. Begin by setting clear goals and understanding your risk tolerance. Utilize technical analysis to identify trends and market behavior, and consider diversifying your portfolio to mitigate potential losses. Remember that trading is not just about profits; it’s also about managing risks effectively.

Another crucial strategy for managing the ups and downs of cryptocurrency trading is to stay informed. Follow reliable news sources and join online communities where you can discuss trends and share insights with other traders. Make use of stop-loss orders to protect your investments from sudden market downturns. Additionally, take regular breaks to avoid emotional decision-making, which can lead to impulsive trades. By maintaining discipline and focusing on long-term strategies, you will be better equipped to handle the inherent volatility of the cryptocurrency landscape.

What Causes Crypto Market Rollercoasters and How to Prepare for Them?

The crypto market is notorious for its rollercoaster-like fluctuations, driven by a myriad of factors. One primary cause is market sentiment, which can shift dramatically based on news, social media trends, and influential figures in the space. Additionally, external economic factors such as inflation rates, global financial instability, and changes in regulatory policies can contribute to sudden market shifts. For instance, a government crackdown on cryptocurrency exchanges can lead to panic selling, while positive news, like institutional investment, can spur massive buying frenzies. Understanding these factors is crucial for anyone looking to navigate the unpredictable waters of crypto.

To prepare for the uncertainties of the crypto market, investors should adopt a well-rounded strategy that emphasizes risk management. This includes diversifying your portfolio to mitigate losses during downturns and employing tools like stop-loss orders to protect your investments. Additionally, staying informed about market trends and news is vital; following reputable sources and engaging with knowledgeable communities can enhance your understanding. Lastly, approaching your investments with a long-term mindset can help reduce the emotional impact of short-term volatility, positioning you better for growth when the market stabilizes.