Carapeastra Insights

Your go-to source for news and information on a variety of topics.

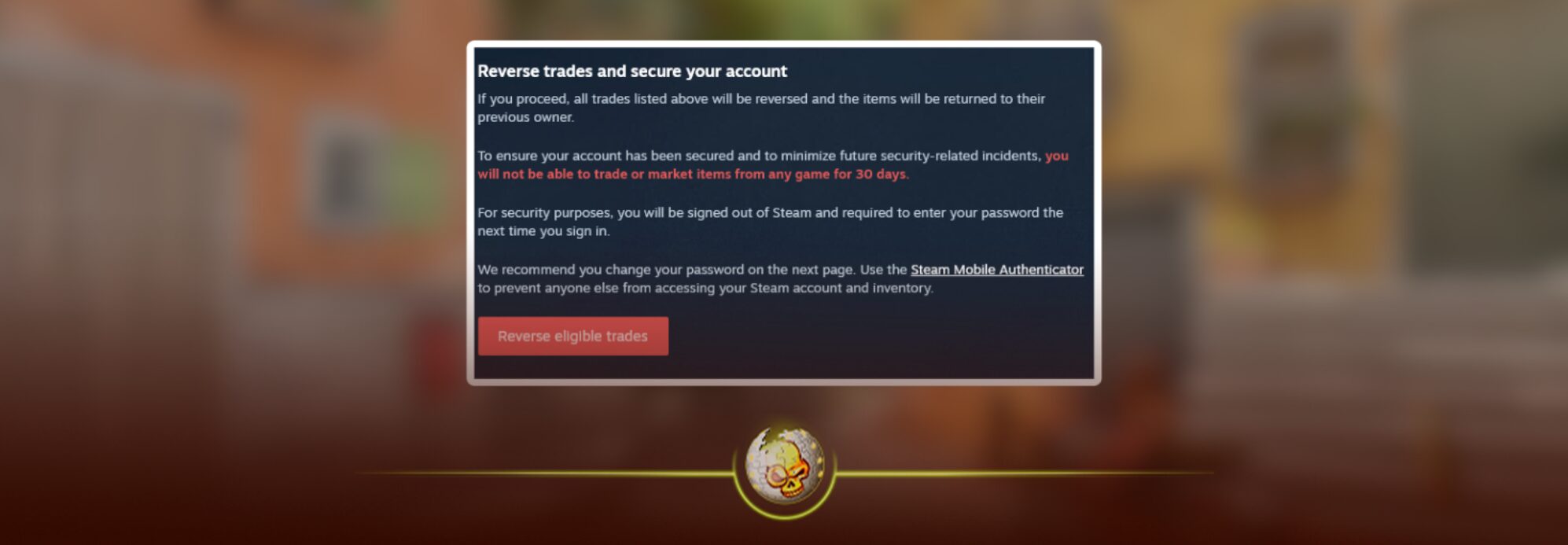

Don't Panic: Effortlessly Undoing Trades in CS2 Without a Hitch

Master the art of trade management in CS2! Discover how to effortlessly undo trades without stress and keep your game on point.

Mastering the Art of Trade Reversals in CS2

Mastering the art of trade reversals in CS2 requires a deep understanding of market dynamics and player behavior. Because players often tend to follow prevailing trends, knowing when to reverse or challenge these trends can provide a significant advantage. One effective strategy is to analyze past performance trends and identify key reversal points where the momentum shifts. By keeping an eye on indicators such as volume and player positioning, you can better anticipate when to make your move.

Furthermore, implementing a systematic approach to trade reversals can enhance your consistency. Here are a few tips:

- Always keep your cool and avoid emotional trading decisions.

- Utilize stop-loss orders to manage risk effectively.

- Stay updated with the latest game patches and player strategies as they can impact market trends.

Counter-Strike is a highly popular tactical first-person shooter game that has captivated players since its initial release. It offers intense gameplay, strategic team-based mechanics, and a competitive environment. Players often seek ways to enhance their gaming experience, such as learning how to reverse trade cs2, which can significantly impact in-game economy and item management.

Your Guide to Effortless Trade Undoing in CS2

In CS2, managing trades efficiently is crucial to maintaining your competitive edge. One of the essential skills every player should master is the art of trade undoing. This technique allows you to reverse a trade that might not have gone as planned, helping you to preserve resources and maximize your strategic advantage in battle. First, ensure that you familiarize yourself with the game mechanics; know the differences between items and their respective values. Understanding these intricacies can help you recognize which trades are worth undoing and when to execute them for optimal results.

To perform an effortless trade undo in CS2, follow these simple steps:

- Open the trade window promptly after initiating a trade.

- Carefully review the items exchanged to identify any items you'd like to retrieve.

- Click on the undo option available in the trade menu.

- Confirm the action to reverse the trade effectively.

Common Mistakes in CS2 Trade Management and How to Avoid Them

Managing trades effectively in CS2 can be challenging, and many traders fall into common pitfalls that can adversely impact their success. One prevalent mistake is the failure to establish clear trade goals and risk management strategies. Without a defined plan, traders often find themselves making impulsive decisions based on emotions, leading to inconsistent results. To avoid this, it is crucial to set specific, measurable objectives and adhere to them. Utilize stop-loss orders to protect your capital and ensure you stick to your trading plan, which will help maintain discipline during market fluctuations.

Another frequent error in CS2 trade management is neglecting to analyze market conditions before entering or exiting a trade. Relying solely on technical indicators or the advice of others can result in missed opportunities or unexpected losses. To mitigate this risk, traders should incorporate comprehensive market analysis techniques, including fundamental analysis, to understand the broader economic landscape. Additionally, keeping a trading journal can help track your decision-making process and identify patterns, ultimately refining your trading strategy over time.