Carapeastra Insights

Your go-to source for news and information on a variety of topics.

On-Chain Transaction Analysis: Decoding the Blockchain's Hidden Secrets

Unlock the mysteries of blockchain with our in-depth analysis of on-chain transactions. Dive in to discover secrets that could change your perspective!

Understanding the Basics of On-Chain Transaction Analysis

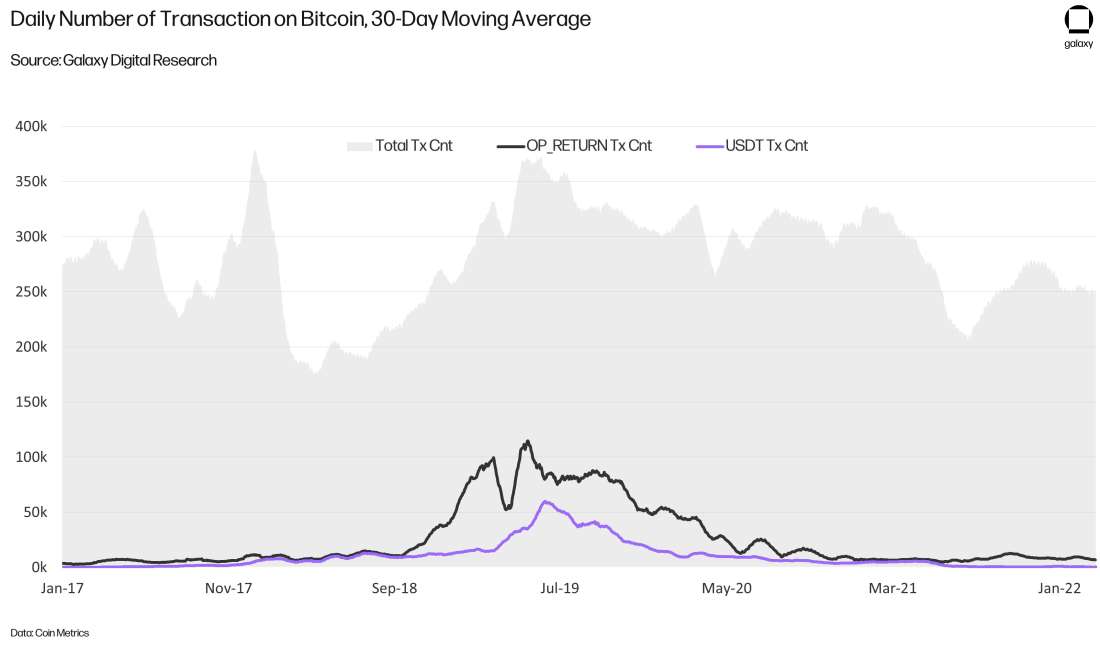

On-chain transaction analysis refers to the process of examining transactions that occur on a blockchain network. This technique enables users to gain insights into the flow of assets, user behavior, and the overall health of the blockchain ecosystem. By analyzing transaction data, individuals and organizations can identify patterns, assess the legitimacy of transactions, and track the movement of cryptocurrencies. As blockchain technology continues to evolve, understanding the basics of on-chain transaction analysis becomes essential for anyone looking to delve deeper into the realms of cryptocurrencies and decentralized finance.

At its core, on-chain transaction analysis involves several key components. First, the identification of transaction inputs and outputs allows analyzers to see who is sending and receiving assets, often represented as public addresses. Next, tools and techniques such as block explorers, graph analysis, and clustering algorithms can be utilized to visualize and interpret the data more effectively. By leveraging these techniques, users can make informed decisions, mitigate risks, and understand market trends. As the cryptocurrency space continues to expand, the importance of mastering on-chain transaction analysis cannot be overstated.

Counter-Strike is a popular series of multiplayer first-person shooter games that has gained a huge following since its release. Players can choose to play as either terrorists or counter-terrorists, completing various objectives. For players looking to enhance their gaming experience, checking out the bc.game promo code can lead to exciting rewards and bonuses.

Top Tools for Analyzing Blockchain Transactions Effectively

In the rapidly evolving world of blockchain technology, analyzing blockchain transactions has become crucial for investors, developers, and researchers alike. Several tools are available that cater to different needs and expertise levels. For beginners, tools like BlockExplorer and Blockchain.com Explorer provide user-friendly interfaces to track transactions on various blockchain networks. More advanced users might prefer options such as Chainalysis and Elliptic, which offer comprehensive analytics and security features, enabling detailed insights into transaction patterns and potential fraudulent activities.

Additionally, open-source tools like EtherScan and TokenAnalyst allow users to delve deeper into specific token transactions and smart contracts. Using these tools effectively involves understanding key metrics such as transaction volume, network fees, and the behavior of unique wallet addresses. For those looking to perform large-scale analyses, GraphQL integrations and API access from platforms like CoinAPI can be invaluable. By leveraging these top tools, users can enhance their ability to analyze blockchain transactions effectively, gaining actionable insights and staying ahead in the blockchain ecosystem.

How to Interpret On-Chain Data: Insights and Strategies

Understanding on-chain data is crucial for anyone looking to navigate the complexities of cryptocurrency markets. On-chain data refers to all the information that is stored on the blockchain, including transaction details, wallet addresses, and smart contract interactions. To effectively interpret this data, one must first become familiar with various analytics tools that allow for visualization and analysis. Tools such as Glassnode, CryptoQuant, and sentiment analysis platforms can provide insights into market trends and help identify potential investment opportunities. Insights drawn from on-chain data can reveal patterns in buying and selling behavior, providing a clearer picture of market sentiment.

Once you've gathered and analyzed the on-chain data, it's essential to develop a strategic approach for its application. Consider employing the following strategies:

- Trend Analysis: Look for recurring patterns in transaction volumes and price movements.

- Wallet Activity Monitoring: Keep track of large wallet movements, as they can indicate potential market shifts.

- Network Health Assessment: Evaluate metrics such as hash rate and active addresses to gauge the overall health of the blockchain.

By implementing these strategies, investors can refine their decision-making processes and improve their chances of success in the volatile world of cryptocurrencies.