Carapeastra Insights

Your go-to source for news and information on a variety of topics.

Veil of Coin: Exploring the Allure of Anonymity in Crypto Platforms

Uncover the secrets of crypto anonymity! Dive into Veil of Coin and explore why privacy in digital currency matters more than ever.

Unveiling the Mystery: How Anonymity Works in Cryptocurrency

The world of cryptocurrency is often shrouded in anonymity, which raises intriguing questions about how transactions can remain private while being recorded on a public ledger. At its core, the suppression of identity in cryptocurrency is facilitated by various techniques that allow users to maintain a degree of privacy. Cryptocurrencies like Bitcoin and Ethereum utilize public-key cryptography, which ensures that while transaction details—such as amounts and wallet addresses—are visible, the identity of the person behind a wallet remains obscured. Additionally, some cryptocurrencies, like Monero and Zcash, have integrated advanced privacy protocols that utilize ring signatures and zero-knowledge proofs to further mask user identities.

However, it's essential to note that while the concept of anonymity in cryptocurrency provides various benefits, such as protecting user privacy and safeguarding against potential state surveillance, it also poses regulatory challenges. Governments around the world are increasingly concerned about the use of anonymous cryptocurrencies in facilitating illegal activities, such as money laundering and tax evasion. To address these issues, some platforms are implementing Know Your Customer (KYC) regulations to ensure that users verify their identities. As the debate around anonymity continues, cryptocurrency enthusiasts must navigate the fine line between privacy and compliance in an evolving digital landscape.

Counter-Strike is a popular first-person shooter game that has been a staple in competitive gaming since its release. Players can choose to be part of either the terrorist or counter-terrorist teams, engaging in various objective-based missions. For those looking to enhance their gaming experience, a cryptocasino.com promo code can provide exciting bonuses.

The Double-Edged Sword of Anonymity: Security vs. Fraud in Crypto Platforms

The evolution of cryptocurrency has brought with it a significant debate surrounding the concept of anonymity. On one hand, anonymity serves as a protective shield, allowing users to engage in transactions with a semblance of privacy. This feature is particularly appealing in regions where financial surveillance poses a threat to personal security. As a result, crypto platforms that prioritize user anonymity can build trust and attract a wider user base. However, this same shield can be a double-edged sword, creating an environment where fraud and illicit activities can flourish without accountability.

Moreover, the lack of transparency associated with anonymous transactions can pose serious challenges for both users and platforms. For instance, fraudulent activities such as scams, money laundering, and phishing attacks often exploit the anonymity feature, leading to significant financial losses for unsuspecting investors. In response, many crypto platforms are now implementing stringent Know Your Customer (KYC) regulations to balance user privacy with the need for security and compliance. This shift highlights the ongoing struggle to find a middle ground between protecting user anonymity and ensuring a safe trading environment within the ever-evolving landscape of cryptocurrency.

Is Anonymity in Crypto Platforms Truly Safe? A Comprehensive Guide

The rise of cryptocurrency has sparked significant interest and debate regarding the concept of anonymity on various platforms. While many users are drawn to crypto for its potential to offer privacy and discretion, the question arises: Is anonymity in crypto platforms truly safe? The short answer is complex. Unlike traditional financial systems, many cryptocurrencies are pseudonymous; transactions are recorded on a public ledger, but the identities behind those transactions are not immediately evident. However, advanced analytics tools can often trace these transactions back to identifiable users, complicating the notion of true anonymity.

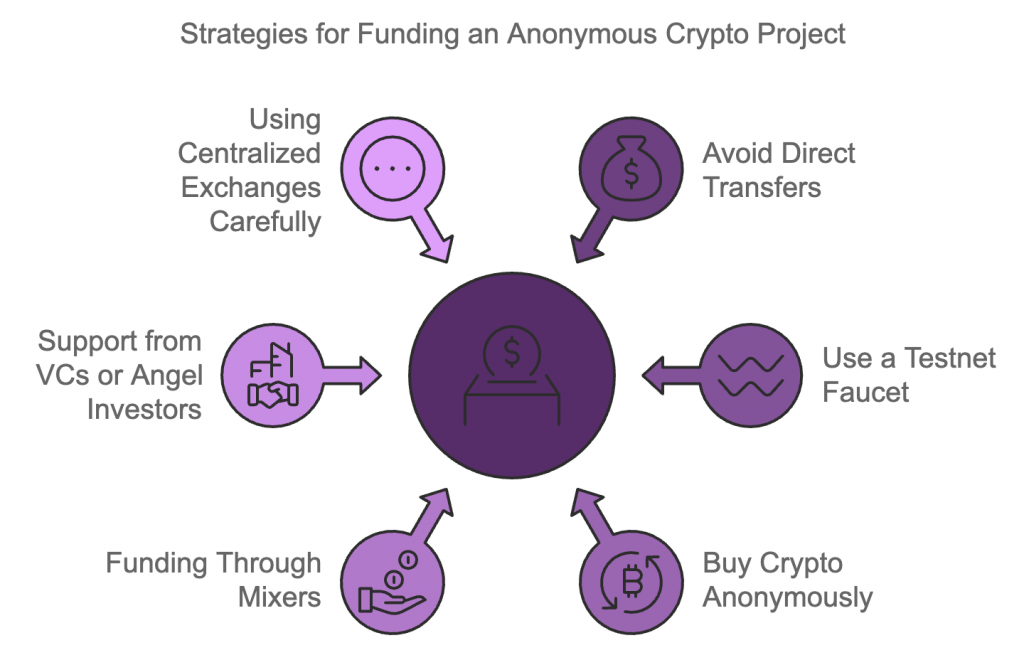

Moreover, platforms that tout anonymity may have varying levels of privacy protection and regulatory compliance. For instance, decentralized exchanges (DEXs) typically offer greater privacy than centralized exchanges, but they may still expose users to unique risks, such as smart contract vulnerabilities. Additionally, users who transact without understanding the underlying technology or without taking necessary precautions can inadvertently compromise their own privacy. To ensure a safer experience, it is advisable for users to educate themselves on the different types of crypto platforms and consider utilizing privacy-focused cryptocurrencies, while also employing best practices like using VPNs and mixing services.